Our ‘Intention to Pay’ ItP Q12 survey assesses customer intent for Loans. This is especially relevant now, as the ability to pay assessed through credit ratings have taken a dip post COVID and for New-to-Credit customers where a credit track is not available. ItP Q12 enables better Credit Risk Management and Risk segmentation.

ItP Q12 Framework (spelt: It-py) The ItP Q12 framework borrows its name from ‘Intention to Pay’ where we pose 12 simple questions to assess borrower behavior behaviour logic across the 4 quadrants: Law Abidance / Morality / Responsibility / Self Preservation – using a Survey methodology.

The scores are recorded as interaction axioms stored as LMRS nodes for creating clusters to denote efficacy of behavior as part of Credit Risk modelling for; enhancing access to new markets lowering of Credit Risk and default creating borrower behavior profiles

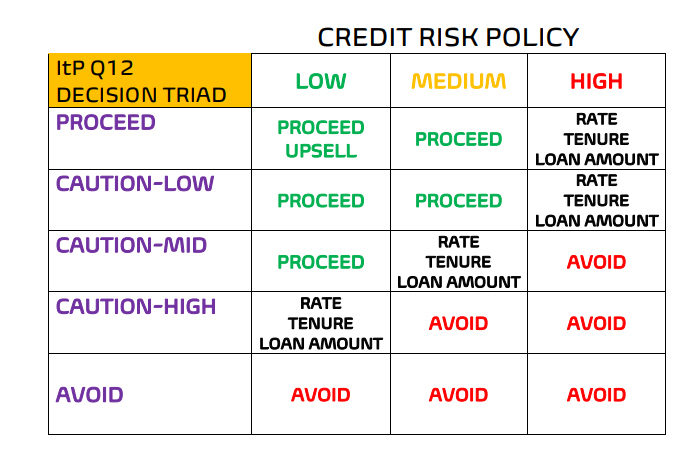

The ItP Decision Triad aims at supplementing the existing Credit lending policy for retail credit .

The ItP test simplifies the concept of Intention to Pay; it needs to be understood as an application from the concept of behaviorism compared to the scoring algorithm to determine ability profiling.

Click one of our contacts below to chat on WhatsApp